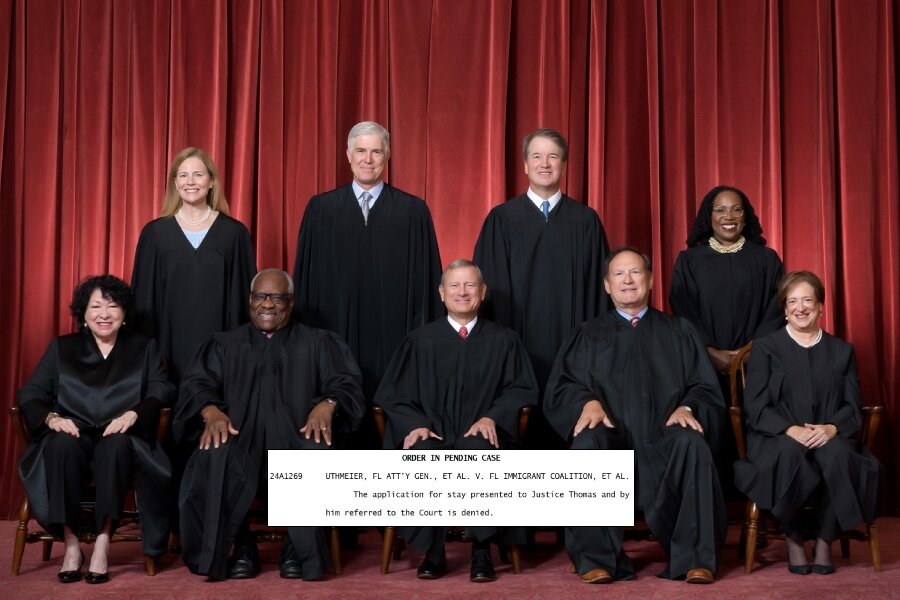

Thursday morning, the Supreme Court ruled 7-2 to uphold a 2017 tax on “unrealized” income from investments made overseas.

Justice Brett Kavanaugh authored the court’s opinion in the case, while Justices Neil Gorsuch and Clarence Thomas dissented from the majority.

The court upheld the Mandatory Repatriation Tax (MRT), commonly known as the Section 965 transition tax, which was included in the Tax Cuts and Jobs Act, passed by the Republican-controlled Congress in 2017 and signed into law by President Donald Trump.

The majority determined that the tax does not violate the 16th Amendment of the U.S. Constitution.

Charles and Kathleen Moore, a married couple from Washington state, contended in a lawsuit that this tax violates the Constitution’s requirement that direct federal taxes must be apportioned among the states and the Constitution’s prohibition against retroactive taxation.

The Moores initially lost their case in U.S. district court, then appealed the decision but lost again. They sought a rehearing from the U.S. Court of Appeals for the Ninth Circuit after a panel upheld the district court’s dismissal of their challenge to invalidate the tax law provision. However, on November 22, 2022, a divided Ninth Circuit once more rejected the Moores’ petition.

“There is no constitutional prohibition against Congress attributing a corporation’s income pro-rata to its shareholder,” the appeals court ruled at the time.

Conservative constitutional experts argued that if the Supreme Court had ruled the MRT violates the 16th Amendment to the U.S. Constitution—permitting income tax without apportionment by population—it could set a precedent limiting Congress from passing laws to tax wealth.

The amendment, ratified in 1913, states: “The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.”

Proposals for wealth taxes are frequently discussed in Congress..In March, Senator Elizabeth Warren (D-Mass.) and House Democrats reintroduced the Ultra-Millionaire Tax Act. This proposal would levy a 2-cent tax on every dollar of wealth over $50 million for the top 0.05 percent of American households.

In November 2023, Senator Ron Wyden (D-Ore.) introduced a plan to tax the unrealized capital gains of high-income earners.

The 2017 law altered how U.S. corporations’ foreign income was taxed. Lawmakers implemented this change because they believed too much money was being invested overseas without benefiting U.S. tax revenues.

Prior to the change, a significant portion of that income remained untaxed until it was brought back, or repatriated, to the United States. To transition to the new system, Congress imposed a one-time tax on accumulated untaxed foreign earnings of U.S. corporations.

The law imposes taxes on U.S. corporate earnings generated abroad over the past 30 years, regardless of whether those earnings have been distributed. It also affects U.S. taxpayers who own 10 percent or more of shares in foreign corporations as of the end of 2017. According to estimates from the Congressional Budget Office in 2018, this legislation is expected to result in corporations facing a one-time tax liability of $347 billion.

The Moores made a small investment in KisanKraft, a company based in India that provides power tools to individual small-scale farmers to enhance their productivity. The Moores held shares in KisanKraft for over ten years but did not receive any dividends because the company reinvested all its profits into its operations.

However, following the enactment of the MRT, the Moores received a $14,729 bill from the IRS for additional income tax owed, even though they had never received any payments from their investment in KisanKraft.

While typically profits are not considered income unless shareholders receive dividends or sell shares for a capital gain, the MRT seeks to tax these funds as income by categorizing them as taxable income. This approach is described as a legal fiction by the Competitive Enterprise Institute, which is representing the couple legally.

Share your thoughts by scrolling down to leave a comment.