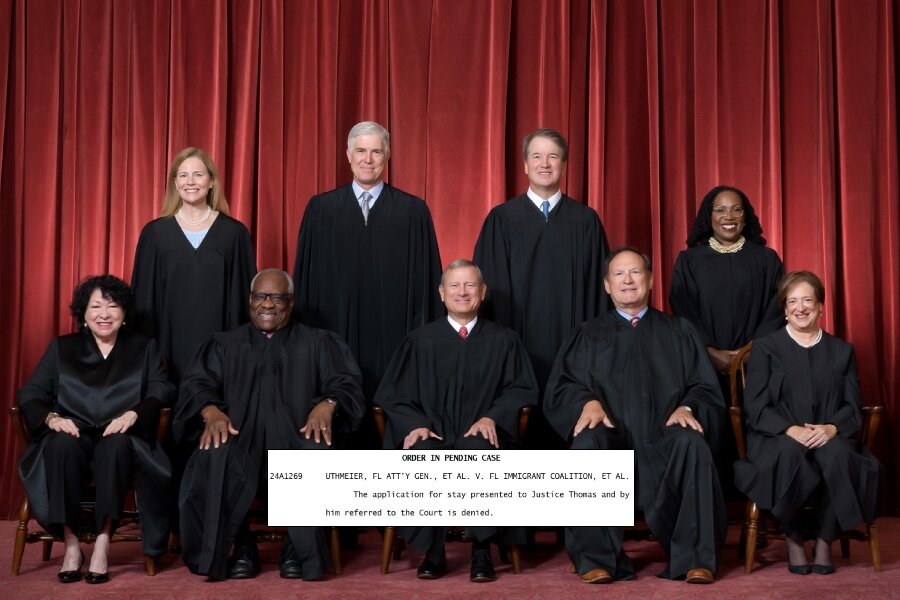

The Supreme Court has chosen not to review the dismissal of a lawsuit brought forth by three whistleblowers alleging that the IRS failed to investigate their assertion that institutional mortgage lenders were not adhering to regulations.

The highest court in the nation declined to grant the request for review in Stone v. Commissioner of Internal Revenue, as per an unsigned order issued on April 1. There were no dissenting opinions among the justices. The court did not provide any reasoning behind its decision. The justices deliberated on the petition during their private conference on March 28.

In order for a petition to proceed to the oral argument phase, it requires the support of at least four out of the nine justices.

David E. Stone, Thomas Carroll, and David C. Depadro alerted the IRS that multiple real estate mortgage investment conduits (REMICs), financial entities used by lenders to manage a portfolio of mortgages and issue mortgage-backed securities, were not adhering to tax exemption regulations. Following Mr. Carroll’s passing, his wife, Kari S. Carroll, assumed his role as petitioner in the legal case.

Americans collectively owe $12.1 trillion on 84 million mortgages, constituting 70.2 percent of the total consumer debt in the United States.

According to the petition, REMICs are established and managed by some of the largest financial institutions globally. They hold nearly all residential mortgage loans in the United States that were issued by institutional lenders.

Despite holding vast sums of money, Congress determined that this income would remain untaxed under specific conditions outlined in the internal revenue code and the code of federal regulations.

The petitioners argued that in actuality, REMICs fail to satisfy the necessary criteria outlined in the tax code or regulations for obtaining tax-exempt status.

“For example, REMICs do not timely obtain or maintain ‘qualified mortgages’ as that term is defined in the Code. REMICs do not even comply with the documentation requirements in their own internal ‘pooling and service agreements.’ For example, REMICs are required by their own internal agreements to maintain promissory notes endorsed by the owners. In practice, they do not.”

“They certainly do not meet the 99% compliance threshold required by the Code of Federal Regulations. That means that, by law, REMICs are not secured creditors holding ‘qualified mortgages,’ but are instead unsecured creditors of the borrowers whose notes and mortgages they claim to own.”

According to the petition, this implies that they should be ineligible for tax-exempt status based on legal grounds.

The petitioners uncovered issues with REMICs and reported their findings to the IRS, which confirmed receipt of the information.

Several IRS investigators verified the accuracy of the information provided, yet the agency declined to conduct interviews with the petitioners.

“It then repeatedly ruled that it will do nothing to collect the taxes owed by REMICs. This is wrong. It cheats every American taxpayer,” the petition states.

The IRS “dropped the ball by failing to collect billions or more in taxes from the largest financial institutions in the world: the entities that underwrote and profited from virtually every residential mortgage in the United States. The big losers in this dispute are everybody else: all the American taxpayers who do follow the rules and pay their fair share of taxes within the bounds of the Code.”

According to the petition, the legal question at hand in the case revolves around whether “the Commissioner, as an arm of the executive branch, has absolute discretion and sovereign immunity under the Administrative Procedure Act [APA] to decline to collect billions of dollars in income taxes on bundled mortgages that are otherwise taxable under the Internal Revenue Code[.]”

The APA, passed in 1946, is a federal law that sets out administrative procedures for federal executive departments and independent agencies.

The late U.S. Senator Pat McCarran (D-Nev.) described the APA as “a bill of rights for the hundreds of thousands of Americans whose affairs are controlled or regulated in one way or another by agencies of the federal government.”

The IRS chose not to present its perspective to the Supreme Court. IRS Commissioner Danny Werfel opted not to reply to the petition, as indicated in a filing made on March 5 by his legal counsel, U.S. Solicitor General Elizabeth Prelogar.

The whistleblowers initially filed a lawsuit in federal court in the Southern District of Florida, alleging that the IRS should have examined and audited certain REMICs and attempted to reclaim owed taxes.

The whistleblowers argued that while the IRS has the “discretion” to choose not to audit specific taxpayers, this discretion doesn’t extend to dismissing an entire revenue category against congressional intent.

Yet, both the federal district court and the U.S. Court of Appeals for the 11th Circuit concluded that the Administrative Procedure Act couldn’t be used to review the IRS’s position.

The 11th Circuit ruled that the executive branch has the authority to opt not to pursue taxes from non-compliant REMICs. Furthermore, the court determined that the whistleblowers cannot use the APA to compel the IRS to take action.

Share your thoughts by scrolling down to leave a comment.