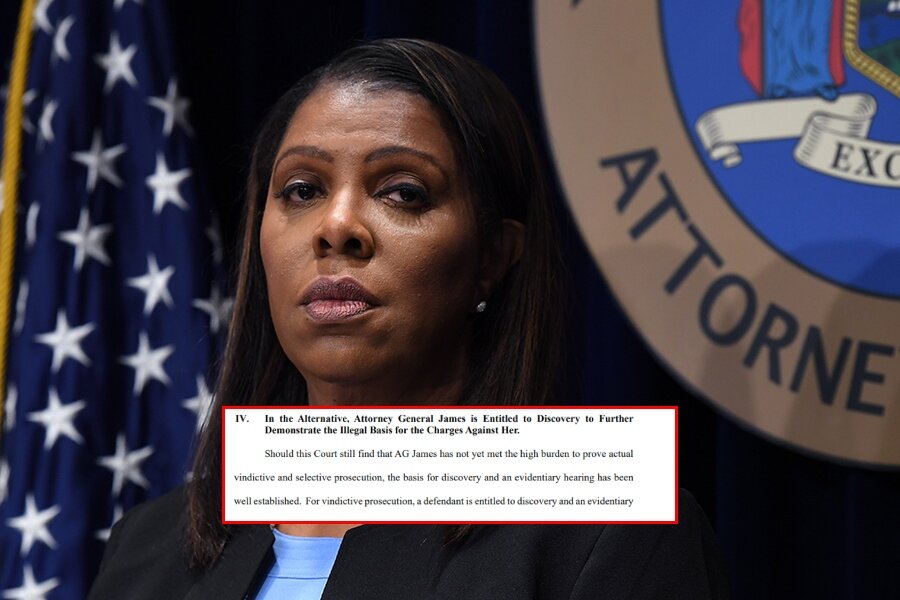

Letitia James’s New York State mortgage records indicate that she committed mortgage fraud on a $200,000 “Credit Line Mortgage” with Citizens Bank in 2021. Like other mortgages, it requires a signed note, a mortgage document, and recording with the county clerk.

The mortgage document shows that James misrepresented her five-unit apartment building as a single-family dwelling. This false claim allowed James to avoid significantly higher commercial loan closing costs and a higher interest rate.

In New York, the number of units in a property determines whether a loan qualifies as a residential mortgage with lower interest rates (1 to 4 family dwellings) or whether it’s a commercial/multifamily building mortgage with higher interest rates and closing costs (5 or more dwelling units).

The official Certificate of Occupancy for Letitia James’s building at 296 Lafayette Avenue in Brooklyn describes it as a “FIVE (5) FAMILY DWELLING.”

That designation is the one and only controlling legal authority for unit count. Yet for two decades after buying the property in 2001, James refinanced multiple times while claiming the building had only four units.

This misrepresentation allowed James to qualify for lower residential interest rates she was not entitled to receive. Even on her most recent refinancing on August 23, 2019, the mortgage document lists four units.

On June 21, 2021, Letitia James signed the $200,000 Credit Line Mortgage with Citizens Bank for a 25-year term. On the first page of the agreement, under “PROPERTY DATA,” the Property Type is listed as “DWELLING ONLY—1 FAMILY.”

This went far beyond James’s past misrepresentations, as she reduced the number to just one. The reason for the overkill appears clear: commercial loan closing costs can be up to seven times higher than residential, and interest rates for commercial properties typically run 1 to 3 percentage points higher.

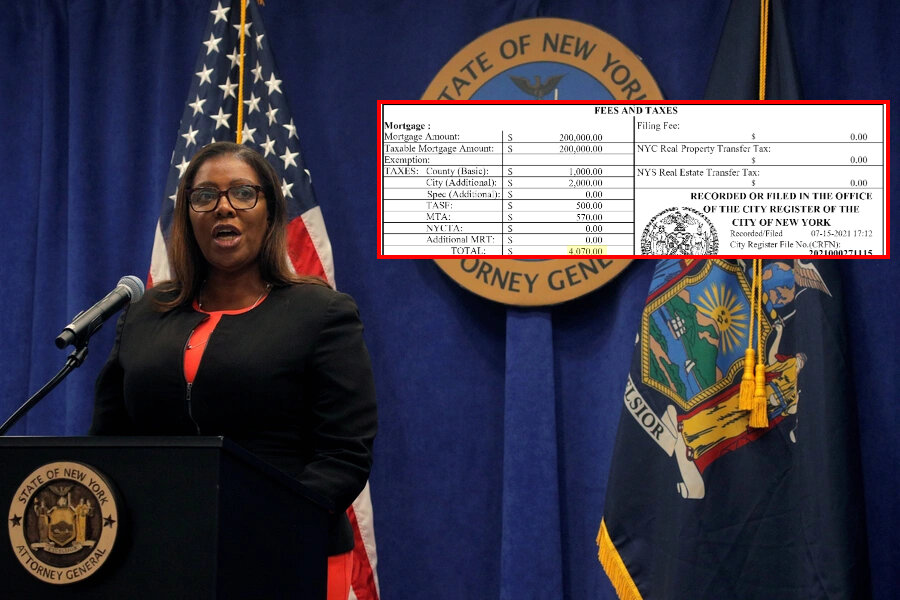

The Citizens mortgage document shows James’s “Fees and Taxes” were only $4,070, covering city and county taxes, a Tax Action Service Fee (TASF), and an MTA surcharge.

Had the property been correctly recorded as five dwelling units, James would have faced a commercial mortgage recording tax of roughly 2.8% of the loan amount, or about $5,600.

In addition, she would have been required to pay for a full commercial appraisal of around $5,000, title insurance, a survey, commercial underwriting, an origination fee, and legal costs.

Altogether, the closing costs would have landed in a range from $20,000 to $30,000, or 10 to 15% of the loan amount.

Under New York Penal Law Article 187, fraud involving a loan of more than $50,000 qualifies as Mortgage Fraud in the Second Degree (PL § 187.20), a Class C felony punishable by up to 15 years in prison.

However, because Citizens Bank is a federally insured FDIC institution, under 18 U.S.C. § 1014, James could see a potential sentence of up to 30 years in prison and heavy fines.

Share your thoughts by scrolling down to leave a comment.