The federal government’s efforts to expand fair lending regulations have hit a roadblock for numerous institutions.

U.S. District Judge Matthew Kacsmaryk ruled on March 29 that the new regulations, set to go into effect on April 1, are founded on flawed interpretations of federal law.

Existing regulations, such as those outlined in the Community Reinvestment Act (CRA), mandate that banks and other lenders offer services to low- and moderate-income individuals within their local communities. The proposed expanded regulations broaden the scope of “community” to encompass any individuals with whom the lenders conduct business.

Government officials claimed that the inclusion of the word “entire” before community in the law prompted a thorough review of the statute and led to the implementation of new rules.

“True, ‘the word ‘entire’ … should not be read out of [the statute],” Judge Kacsmaryk wrote in his ruling. “But it does not have the effect defendants attribute to it. In modifying ‘community,’ the word ‘entire’ merely clarifies that the whole community must be served, it does not change what a ‘community’ is. If a statutory ‘community’ is created around every individual customer with whom a bank does business—regardless of whether that customer is within the geography of the bank’s physical presence—the term becomes meaningless and the statute ineffectual.”

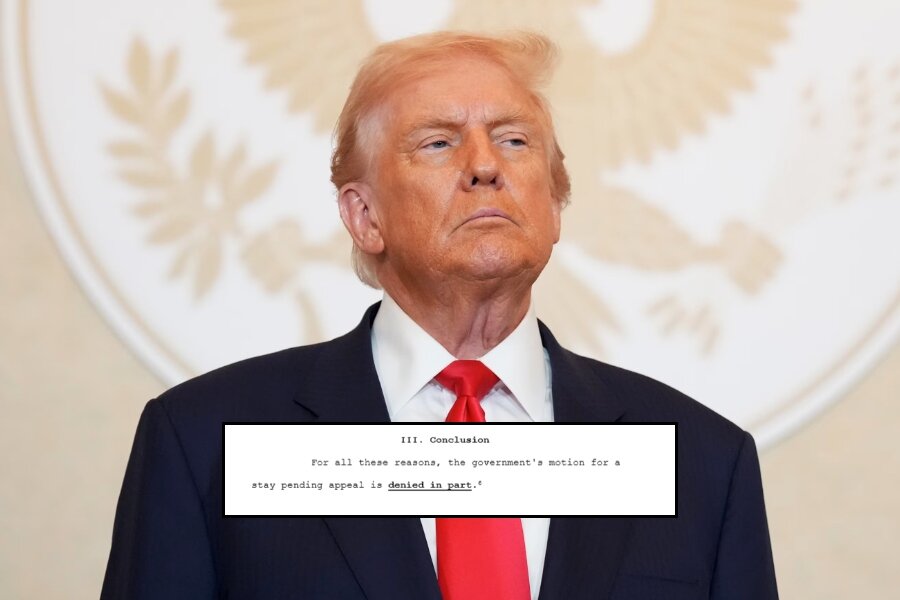

The judge, selected by former President Donald Trump, additionally stated that the portion of the new regulations permitting federal banking agencies (FBAs) to assess deposits, rather than solely focusing on credit activities, was founded on a misinterpretation of the law.

He highlighted the language of the law, which mandates that agencies shall “assess the institution’s record of meeting the credit needs of its entire community, including low- and moderate-income neighborhoods”.

This assessment should consider capital investment, loan participation, and other ventures undertaken by the institution, provided they contribute to meeting the credit needs of local communities.

“Not a single foregoing provision—nor any other CRA provision—authorizes the FBAs to assess deposit products,” he added.

The preliminary injunction halts the implementation of the rules for various entities, including the U.S. Chamber of Commerce, which filed a lawsuit against them. The groups argued that the rules should be halted due to their illegality.

“We welcome this decision by the Northern District of Texas pausing implementation of the Community Reinvestment Act final rules until the litigation we filed challenging the rules can be resolved,” the groups said in a joint statement.

“While we strongly support the goals of CRA, the final rules exceeded the banking agencies’ regulatory authority and created disincentives for banks to lend in low- and moderate-income communities that need access to credit the most. We look forward to litigating this matter to a final judgment.”

The Office of the Comptroller of the Currency, led by a director appointed by the president, along with the Federal Deposit Insurance Corporation and the Federal Reserve, unveiled the new regulations in 2023 and released their final versions earlier this year.

The agencies did not respond to requests for comment on the order.

The lawsuit was filed in Amarillo, where Judge Kacsmaryk is the only active judge, and one of the plaintiffs, the Amarillo Chamber of Commerce, is located. Four other plaintiffs are headquartered in Washington, while the remaining ones are located in various regions of Texas.

In recent years, Judge Kacsmaryk has made headlines for issuing nationwide injunctions against government policies, such as the endorsement of an abortion pill. The case is presently being reviewed by the U.S. Supreme Court.

Share your thoughts by scrolling down to leave a comment.