The IRS has announced a delay in requiring gig workers to report payments exceeding $600 made through third-party payment apps like Zelle, Cash App, Venmo, and PayPal.

The delay of this rule is a win for gig workers who work multiple jobs to make ends meet in Biden’s struggling economy.

Sixteen percent of Americans are involved in the “gig economy,” although not all survey participants received payments through third-party apps, according to Pew Research.

“It’s clear that an additional delay for tax year 2023 will avoid problems for taxpayers, tax professionals and others in this area,” IRS Commissioner Danny Werfel stated.

The delay might result in a cost of approximately $2 billion for the Treasury.

As reported by The Wall Street Journal:

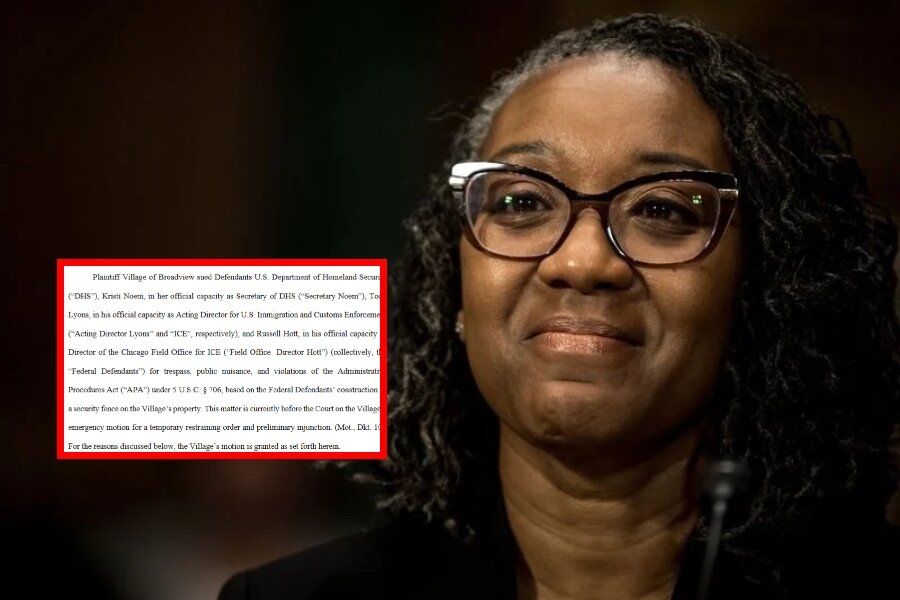

For the second straight year, the IRS postponed enforcement of a law that requires those e-commerce and payment platforms to send the agency information about many users who receive more than $600 in revenue a year.

The old threshold — more than $20,000 in revenue and 200 transactions — will remain in effect for tax year 2023. The IRS will begin transitioning toward the new system in tax year 2024 and will use a $5,000 threshold that year.

The delay doesn’t change what taxes anyone owes, just what online platforms must report to the IRS. The move could prevent tax-filing headaches for many people. The IRS said Tuesday it was concerned about mass confusion if an estimated 44 million Forms 1099-K were sent in early 2024 to taxpayers and to the IRS.

The regulation stemmed from President Biden’s American Rescue Plan Act of 2021, aiming to urge American workers to “pay your fair share.”

This concept, initially advocated for the wealthy, is now extended to average Americans.

Share your thoughts by scrolling down to leave a comment.