IRS Commissioner Danny Werfel was questioned by lawmakers on Capitol Hill last week, suggesting the possibility that, contrary to its repeated promises, the agency might increase tax audits for Americans earning less than $400,000.

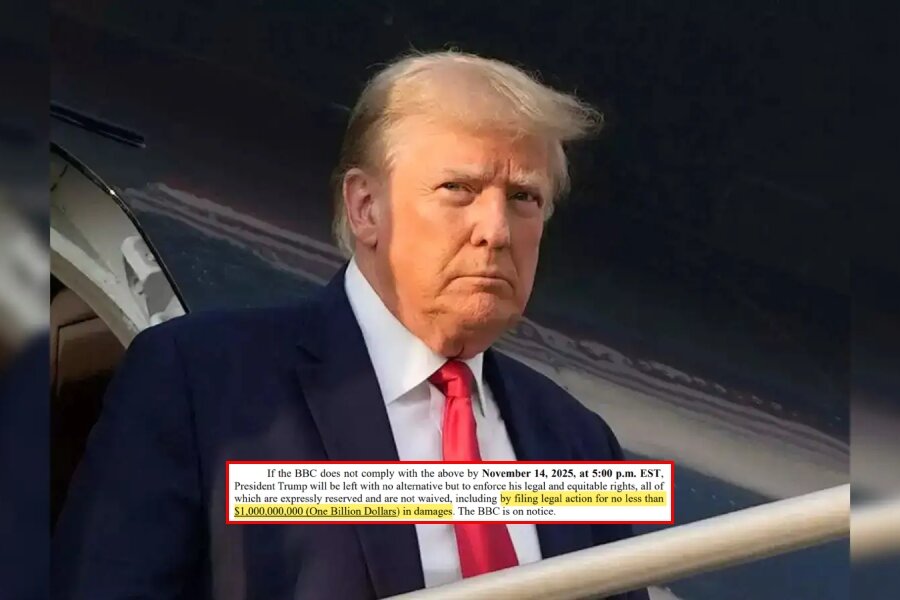

The debate over whether the IRS plans to allocate some of the approximately $80 billion funding increase to enhance tax enforcement on individuals earning under $400,000 has sparked disagreement.

Officials from the IRS and Treasury Department have promised not to raise audit rates for this category of Americans. Meanwhile, Republicans and others have contended that this promise is either false or wishful thinking.

Treasury Secretary Janet Yellen has directed the IRS not to raise audit rates above historical levels for this group of taxpayers, while Mr. Werfel has repeatedly made the same pledge.

However, a recent watchdog report raised concerns about this commitment, cautioning that individuals earning less than $400,000 might become targets of increased enforcement. This is due to the IRS lacking a precise definition of “high-income,” relying on an outdated $200,000 high-income threshold as their default.

Meanwhile, the latest data on the tax gap (the difference between taxes owed and paid to the government) show that it has jumped from $601 billion to $688 billion, putting pressure on the IRS to ramp up enforcement and bring in more money for all the Biden administration’s big spending plans.

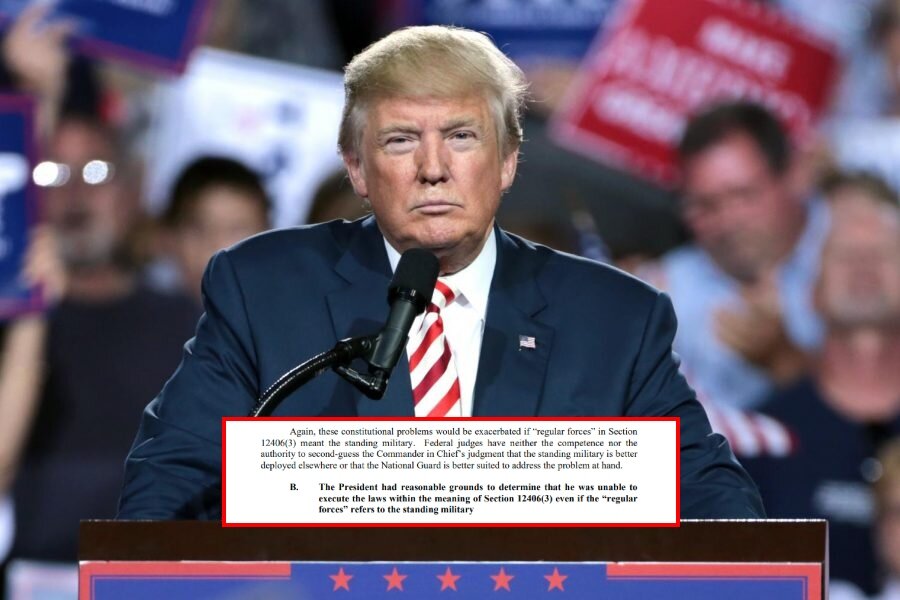

During the October 24 hearing on Capitol Hill, Representative Gary Palmer (R-Ala.) highlighted that former IRS Commissioner John Koskinen had previously testified that raising tax audits as a method to shrink the tax gap was not a recommended strategy.

“One of your predecessors, John Koskinen, testified before this committee in 2015, and he said it would not be advisable to audit your way out of the tax gap, yet that’s exactly what you’re trying to do,” Mr. Palmer said.

To boost tax collections, the IRS has pledged to intensify tax enforcement on corporations and high-income filers. They aim for a “sweeping, historic” crackdown targeting individuals they claim are wealthy tax evaders.

During his questioning, Mr. Palmer suggested that the IRS’s drive to increase collections might inadvertently involve some lower-earning Americans in those efforts.

Mr. Werfel stated that he instructed IRS staff not to raise audit rates for lower-income Americans. However, he hinted at the possibility of this occurring inadvertently, with the ultimate outcome to be determined over time.

Share your thoughts by scrolling down to leave a comment.