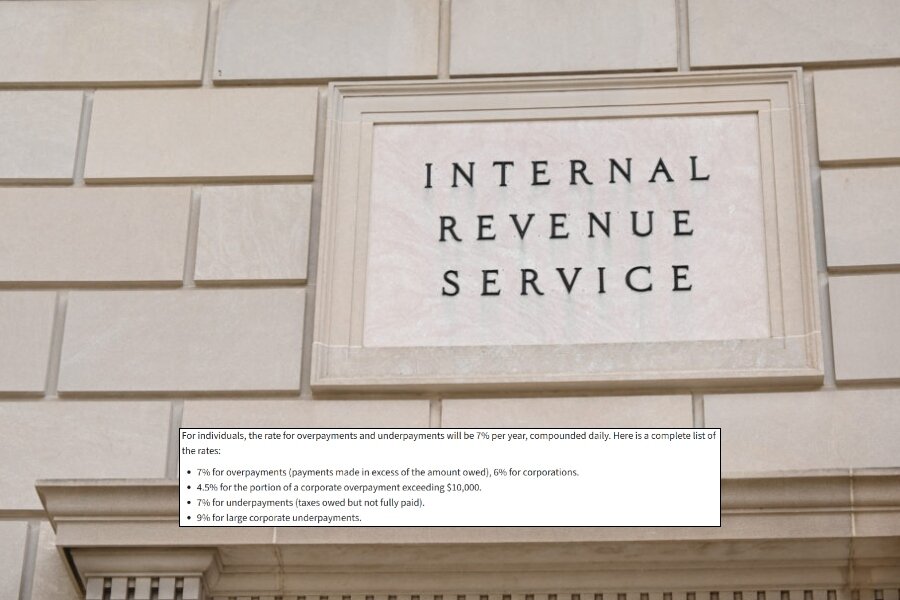

Interest rates for overpayments and underpayments will remain the same for the calendar quarter beginning Oct. 1, 2025, the IRS said in an announcement on Aug. 25.

The IRS issues refunds without interest for overpayments until 45 days pass, after which interest is paid to the taxpayer. For individuals, the rate for overpayments and underpayments will be 7 percent per year, compounded daily.

It remains at 6 percent for corporations. The rate is determined every quarter, and the current rates are set for the period Oct. 1 to Dec. 31.

For corporate overpayments exceeding $10,000, the interest rate is 4.5 percent, and for large corporate underpayments, it’s 9 percent.

For non-corporations, the overpayment and underpayment rate is the federal short-term rate plus 3 percentage points. The current annual federal rate is 4.33 percent.

For corporate underpayments, it’s a similar increment. For overpayments, it’s an additional 2 percentage points. For large corporations, 5 percentage points are added to the federal rate when calculating underpayments.

The rate on the portion of a corporate overpayment of tax exceeding $10,000 for a taxable period is the federal short-term rate plus one-half (0.5) of a percentage point, said the agency. The interest rates are computed from the last month’s federal rates.

The federal funds rate has remained unchanged in the range 4.25–4.5 percent since the beginning of the year.

People who overpaid can expect a refund check in 4–6 weeks. An overpayment credit fund is automatically given. However, taxpayers can request the agency to apply the credit as an advance payment for the following year’s taxes.

An option to check the refund status is available online.

Similarly, the IRS will send a notice when taxpayers underpay the amount of taxes due.

Share your thoughts by scrolling down to leave a comment.